Today at the plenary session of the Majilis the deputies appealed to the President to dissolve the Majilis and arrange extraordinary elections

The President signed a number of laws

The President instructed the National Bank together with the government to draft a law on amnesty of capital

The RoK President has signed amendments concerning the RoK international treaties

Nursultan Nazarbayev, the RoK President has signed the Law of the Republic of Kazakhstan “On amendments to some legislative acts of the Republic of Kazakhstan on international treaties of the Republic of Kazakhstan “, as reported by the press service of the head of state. Source: NA Zakon.kz. The Law provides for the introduction of… Read More

The president supports a tax on luxury

The president supports a tax on luxury. At the same time he believes that it is impossible to increase taxes for the middle class. Reach people of Kazakhstan should bear the social responsibility to the people and direct their wealth on the development of the country. At the XV Congress of the People’s Democratic Party… Read More

About the correctness of applying the “0” correction factor during the period of crisis situations

Laura Satybaldina, Senior Manager of MinTax LLP, in her article considers the issue of the correctness of application by taxpayers of the “0” correction factor which was introduced as a measure to ensure socio-economic stability for the period of the crisis situation in 2020 due to the COVID-19 pandemic. As you may remember, in March… Read More

Concerning the assessment of Social tax after applying the “0” coefficient

Dear Taxpayers of the RoK[1], In connection with the incoming questions regarding the assessment of Social tax after applying the “0” coefficient when calculating the amounts of social charges payable, we would like to make the following clarifications. The Decree of the RoK Government No. 721 dated October 30, 2020, introduced amendments to the Decree… Read More

Notification (November, 2020)

Notification (October, 2020)

Notification (September, 2020)

Notification (August, 2020)

Notification (July, 2020)

Notification (June, 2020)

Base rates of MCI , MW for 2020 (with changes in the April 1, 2020)

Concerning the adjusted republican budget for year 2020 In accordance with the Edict of the President of the Republic of Kazakhstan #299 dated 8 April 2020 “Concerning the adjusted republican budget for year 2020”, the following shall be established from 1 April 2020: 1) the minimum amount of the state basic pension payment – KZT… Read More

Notification (May, 2020)

Concerning the adjusted republican budget for year 2020

In accordance with the Edict of the President of the Republic of Kazakhstan #299 dated 8 April 2020 “Concerning the adjusted republican budget for year 2020”, the following shall be established from 1 April 2020: 1) the minimum amount of the state basic pension payment – KZT 17,641; 2) the minimum pension – KZT 40,441;… Read More

The Government adopted the Decree establishing the measures for stabilizing the economy

On 20 April 2020 the Government of the Republic of Kazakhstan adopted and published the Decree No.224 “On Further Measures for Implementing the Edict of the President of the Republic of Kazakhstan No.287 dated 16 March 2020 “On Further Measures for Stabilizing the Economy” on Taxation Issues”, which, in accordance with the Edict of the… Read More

On Further Measures Aimed at the Economy Stabilization in the Context of Tax Policy

On 27 March 2020 the Government of the RoK[1] issued the Decree No.141 “Concerning Measures for the Implementation of the Presidential Edict No.287 dated 16 March 2020 “On Further Measures Aimed at the Economy Stabilization in the Context of the Tax Policy” (hereinafter – the “Decree No. 141”), which prescribes the following: For the period… Read More

Concerning the support of Kazakhstan’s business in the President’s Address

According to the State of the Nation Address of the President Kasym-Jomart Tokayev dated 2 September 2019 “Constructive Public Dialogue – The Basis of Stability and Prosperity of Kazakhstan”, the state and society are expected to face important socio-economic changes. In particular, the President’s Address proclaims important changes in the sphere of support of micro- and… Read More

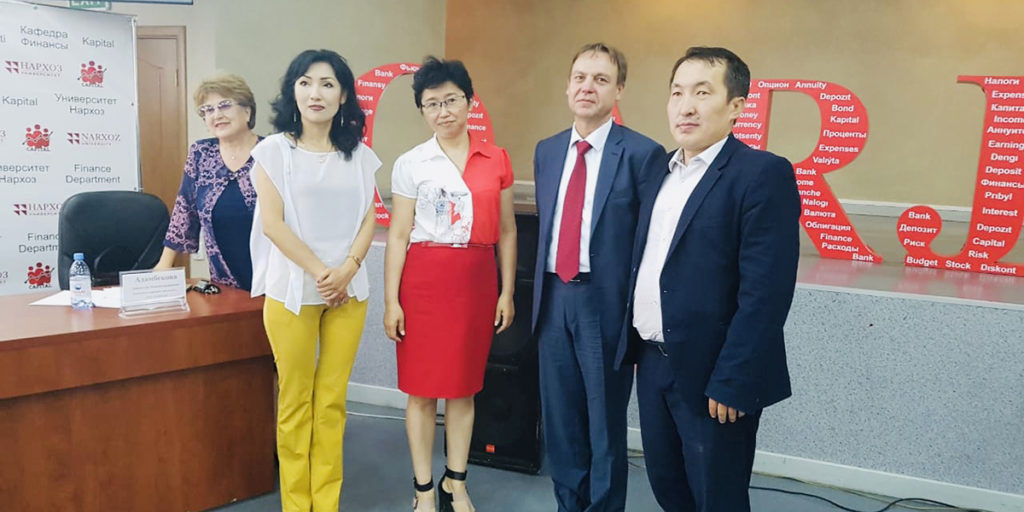

Participation in the first meeting of Tax Club pilot project

The “Chamber of Tax Consultants” Public Association (republican status) together with the NARXOZ University launched a pilot project “Tax Club”, the first meeting of which was held on June 5, 2019 at 15-00 at the address: Almaty, ULK, 81 Sain Street, room 220. The speakers of this meeting on the subject: “Tax security of the… Read More

Seminar on the procedure for CIT assessment for the members of the Accountants Club

As part of the professional development program of the Accountants Club organized by Almaty regional department of “Atameken” National Chamber of Entrepreneurs, on 10th of December 2018 MinTax Group conducted a seminar on the subject “The procedure for the assessment of Corporate Income Tax established by the norms of the new Tax Code. The procedure… Read More