MinTax Group represented by Gaukhar Narbekova – Partner, Director of the Audit Department and Yerlan Galiyev – Independent Partner, Attorney, took part in a conference on the topic: “Tax and Customs Administration Issues”, which was organized and held on February 14, 2020 by the Kazakhstan Taxpayers Association (KTA) in conjunction with the State Revenue Committee… Read More

Code On Administrative Offences of the Republic of Kazakhstan 2014.07.04-kaz

Code On Administrative Offences of the Republic of Kazakhstan 2014.07.04-rus

Code On Administrative Offences of the Republic of Kazakhstan 2017.07.11-kaz

Code On Administrative Offences of the Republic of Kazakhstan 2017.07.11-rus

Code On Administrative Offences of the Republic of Kazakhstan 2018.05.04-kaz

Code On Administrative Offences of the Republic of Kazakhstan 2018.05.04-rus

Code On Administrative Offences of the Republic of Kazakhstan

IS “ASTANA-1” (ASYCUDA) – innovations in the customs administration

IS “ASTANA-1” (ASYCUDA) – innovations in the customs administration

The new RoK Code on Administrative Offences came into force

According to the Minister of Eurasian Economic Commission, the entrepreneurs’ interests are given the priority for the Customs Code drafting

The Code on Administrative Offences is ready for the first reading.

More than 26 000 taxpayers were applied administrative penalty in the form of notification

Amendments introduced on 01.01.2013 to CoAO provides for a notification instead of imposing a penalty on taxpayers, who performed violation for the first time in the area of taxation. Source: http://nda.kz. Tax Authorities of Almaty based on results of 11 months of 2013 identified 35 903 evidences of committing the administrative offences in the area of taxation.… Read More

Overbalance of lawyers and administrators at the employment market

These are the results of study of HeadHunter, Kapital.kz Business Portal reports. Research Center of HeadHunter has analyzed about 11 thousand vacancies and 720 thousand responses in September on hh.kz and find out in which professional fields found to have maximum competition. Last month, for the sentence in the professional fields of “administrative staff» and… Read More

New amendments in the criminal and administrative legislation

Republic of Kazakhstan Law No.490-IV ЗРК dated 9th November 2011 “On Entering Amendments into Certain Legislative Acts of the Republic of Kazakhstan on Issues of Enhancement of Law Enforcement and Further Humanization of Criminal Legislation (hereinafter – the Law) was put into effect on 30 November 2011. Significant amendments were entered into the Criminal Code… Read More

Certain issues related to deferred VAT

About the correctness of applying the “0” correction factor during the period of crisis situations

Laura Satybaldina, Senior Manager of MinTax LLP, in her article considers the issue of the correctness of application by taxpayers of the “0” correction factor which was introduced as a measure to ensure socio-economic stability for the period of the crisis situation in 2020 due to the COVID-19 pandemic. As you may remember, in March… Read More

Yerlan Galiyev commented on the possibility of wearing camouflage clothes

Yerlan Galiyev, Independent partner, Lawyer spoke on Atameken Business TV channel in the Grani (Edges) talk show. During the discussion, Yerlan Galiyev commented on the legal issues of the possibility of using camouflage uniforms by civilians, specific issues of bringing to administrative responsibility, informed when wearing such clothes is permissible. https://youtu.be/2dM4EDOXmX8

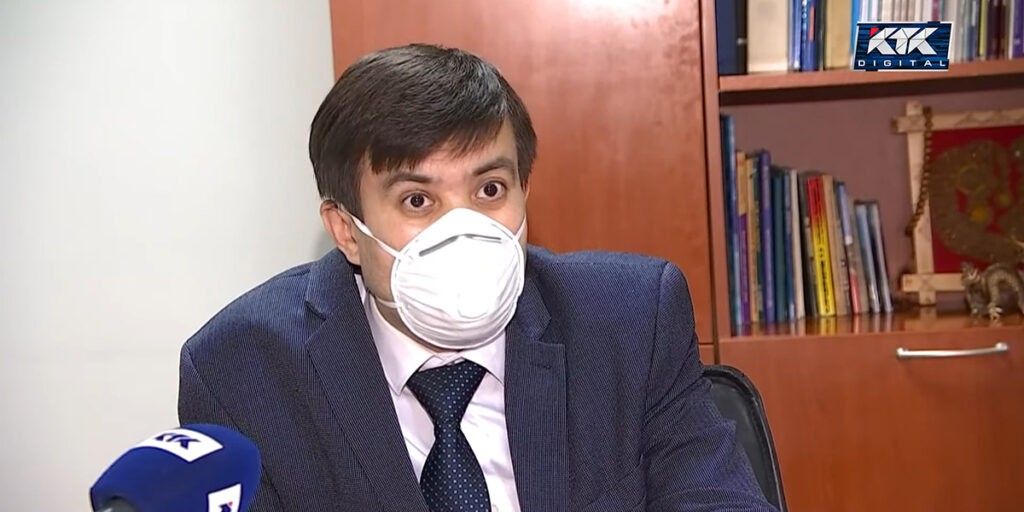

Yerlan Galiev against cutting down trees

Yerlan Galiyev – Independent partner, Lawyer spoke on KTK TV channel against cutting down trees. As Yerlan Galiyev said, we should not be indifferent to this. Not only the Government, but also the public (every one of us) must immediately stop such acts when they are identified. Responsibility (not only administrative, criminal, but also civil)… Read More

Procedure for the presentation of transactions under long-term contracts in the accounting and tax records

In this article, Gaukhar Narbekova, Partner of MinTax Group, Director of the Audit Department, describes the procedure for the presentation of transactions under long-term contracts in the accounting and tax records using an example taken from practical experience in the course of rendering audit and consulting services to organizations providing services to subsoil users. In… Read More

Certain changes in the procedure for issuing accompanying notes in respect of goods

Dear taxpayers of the Republic of Kazakhstan, According to the Order of the Minister of Finance of the Republic of Kazakhstan #1006 dated 14 October 2020 “On introducing amendments to the Order of the First Deputy Prime-Minister of the Republic of Kazakhstan – the Minister of Finance of the Republic of Kazakhstan No. 1424 dated… Read More

Changes in the rules and deadlines for implementing the accompanying notes in respect of goods

Dear taxpayers, considering that a mandatory procedure for issuing ANs[1] will be introduced in the nearest future, more and more frequently we are receiving inquiries on how the issue procedure is going to take place and who will be obliged to issue ANs. In this regard, we would like to inform that a draft Order… Read More

Changes in the rules and deadlines for implementing the accompanying notes in respect of goods

Dear taxpayers, considering that a mandatory procedure for issuing ANs[1] will be introduced in the nearest future, more and more frequently we are receiving inquiries on how the issue procedure is going to take place and who will be obliged to issue ANs. In this regard, we would like to inform that a draft Order… Read More