On October 26, 2018 Mr. Yerlan Galiyev, Independent Partner of MinTax Group conducted a seminar at Kazakhstan’s Taxpayer Association on the subject “Important issues related to the court procedure for appealing the results of tax audits”. The seminar was dedicated to topical practical issues of appealing the results of tax audits in the courts of… Read More

Based on results of tax audits, amount of 31 billion of KZT was paid to the budget

Tax inspections have been reduced by 2 times compared to the last year. Source: ZAKON.KZ IA. Since 2013, Tax authorities of Almaty has performed 1430 complex and limited scope audits based on results of which 31,7 billion Tenge was additional paid to the budget. Currently 9,6 billion tenge has been charged. Currently, we are working on other… Read More

National Bank expects inflation on the results which will be close to the low level of a range– 6- 8 %.

Astana. 23 October. National Bank expects inflation on the results which will be close to the low level of a range of 6- 8 % as reported by Kazakhstan Today news agency. Kairat Kelimbetov, chairman of the National bank of the RoK informed during the meeting that the National Bank expects that based on results… Read More

Summary results of the socio-economic development of Kazakhstan

About the correctness of applying the “0” correction factor during the period of crisis situations

Laura Satybaldina, Senior Manager of MinTax LLP, in her article considers the issue of the correctness of application by taxpayers of the “0” correction factor which was introduced as a measure to ensure socio-economic stability for the period of the crisis situation in 2020 due to the COVID-19 pandemic. As you may remember, in March… Read More

Check the correctness of CIT assessment

MinTax Group offers a new service for taxpayers of the Republic of Kazakhstan – Express check of correctness of the calculation of the Corporate income tax (CIT). This check will be carried out by us based on the data of companies’ accounting database. Conducting an express check, in our opinion, will allow to solve the… Read More

Procedure for the presentation of transactions under long-term contracts in the accounting and tax records

In this article, Gaukhar Narbekova, Partner of MinTax Group, Director of the Audit Department, describes the procedure for the presentation of transactions under long-term contracts in the accounting and tax records using an example taken from practical experience in the course of rendering audit and consulting services to organizations providing services to subsoil users. In… Read More

MinTax Audit LLP – “Leader of the Branch 2020”

According to the report of the National Business Rating in the Republic of Kazakhstan, MinTax Audit LLP is a laureate of the rating of the best taxpayers in the region (Almaty) and the country, based on the results of year 2019. The Company results in the National Business Rating: 2nd place (Gold) among enterprises of… Read More

Important changes in the labour legislation of the RoK

Ulan Batenov, Manager of Legal Department of MinTax LLP, in his article considers some changes introduced to the labor legislation of the Republic of Kazakhstan (RoK) by the RoK Law #321-VІ ZRK dated 4 May 2020. The reason for writing this article, as mentioned in the introduction, were the numerous changes made to the RoK… Read More

Tax obligations related to granting loans to non-residents – related parties

Gaukhar Narbekova, Partner of MinTax Group, Certified Auditor, DipIFR (ACCA), CIPA, CAP, Professional Tax Advisor, Tax Consultant of the RoK[1] in this article considers possible variants of granting a loan by a legal entity – resident of the RoK (hereinafter – RoK Resident) to its Participant or its related party which are non-residents of the… Read More

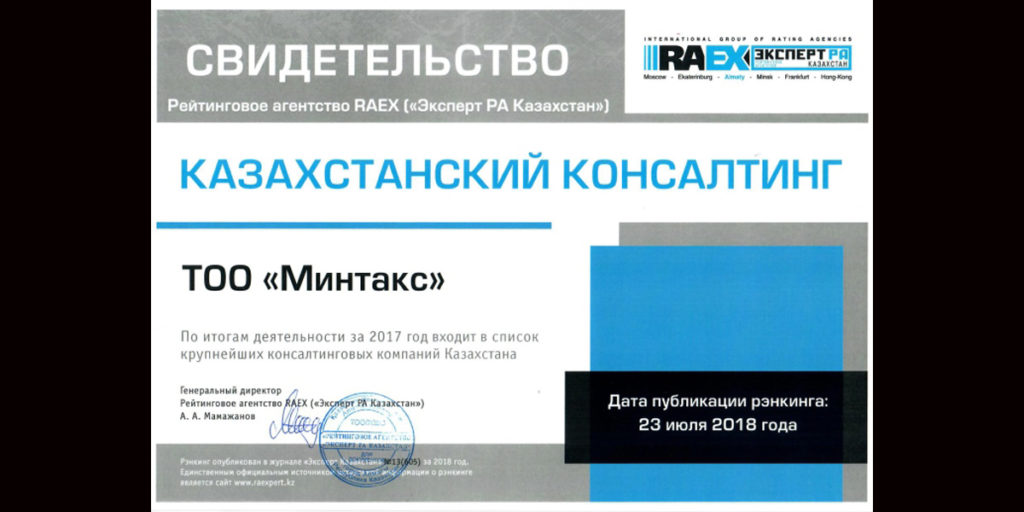

We are in the TOP-10 of the leading auditing and consulting groups of Kazakhstan in 2018

According to results of the regular ranking of Kazakhstan’s auditing and consulting companies based on 2018 performance results, prepared by Expert RA Kazakhstan Rating Agency, MinTax Audit LLP and MinTax LLP are still holding the leading positions in the list of auditing and consulting groups of Kazakhstan. In particular, according to 2018 performance results, MinTax… Read More

Important changes in state purchases in 2019

Saltanat Seilbekova, Consultant of MinTax LLP, in her article considers important changes in the sphere of purchases that took place in 2019. In the beginning of year 2019, some amendments and additions were introduced to RoK[1]legislation regulating the sphere of state purchases, purchases of Samruk Kazyna National Welfare Fund JSC[2] and purchases of subsurface users.… Read More

We are holders of the “Industry Leader” title

MinTax Group companies are in the TOP list in their area of activity according to results of the independent ranking analysis held in 2019 by the Union of National Business Ratings (NBR Union) among the entities doing business in the sphere of audit, tax consulting, accounting. The analysis was based on information about the payment… Read More

New measures for the government support of young specialists

For material support of young specialists, the Government has introduced a number of measures. Based on the youth labour market indicators for the Republic of Kazakhstan in 2001–2018[1], we can see that the youth unemployment rate in the Republic of Kazakhstan is declining. In particular, according to results of the 4th quarter of 2018, the… Read More

Which taxpayers are exempt from the maintenance of accounting records in the RoK?

Current legislative standards According to paragraph 1 of Article 2 of the RoK Law “On Accounting and Financial Reporting”, the effect of this Law shall extend to: individual entrepreneurs (IE); legal entities, branches, representative offices and permanent establishments of foreign legal entities registered in the Republic of Kazakhstan in accordance with the legislation of the… Read More

Search

For legal persons, except for subsoil users and legal entities, produc for 2017

2017 TAX CALENDAR for legal entities, other than subsurface users and legal entities who are producers of agricultural products, aquacultural (fishery) products and rural consumer cooperatives Abbreviations: 1. TAXES: 1.1. CDB – Commercial Discovery Bonus; 1.2. LT – Land Tax; 1.3. PIT – Personal income tax; 1.4. CIT – Corporate Income Tax; 1.5. MET – Minerals… Read More

Tax deduction. Error in the example of the Methodological Guidelines may lead to tax disputes

We are in the Top-5 of Kazakhstan’s leading auditing and consulting groups for year 2017

«Premium Solutions» Firm of Attorneys

THE TAX LAWYER The «Premium Solutions» Firm of Attorneys closely cooperates with MinTax Group. Yerlan Galiyev, the Attorney is a Director of the Law Firm. His is a member of the College of Advocates of Almaty city, the Alliance of Advocates of the Republic of Kazakhstan. Our advocates have considerable experience in representing… Read More

Legal aspects

The name MinTax Group may refer to MinTax LLP, MinTax Audit LLP and to «Premium Solutions» Firm of Attorneys, as well to their structural subdivisions depending on the context. MinTax LLP, MinTax Audit LLP and «Premium Solutions» Firm of Attorneys are companies-partners acting on the basis of the Partnership Agreement and are separate and independent… Read More

Taxation of Subsurface Users

Presentation of MinTax Group See the Price Policy Since 1999, from the date of incorporation we have been providing services related to matters concerning taxation of subsurface users, whereas our partners and managers participated in expertise process of draft contracts for subsurface use and preparation of tax legislation in part of taxation of subsurface users… Read More

Tax Disputes

Presentation of MinTax Group See the Price Policy Services for investigation of legality of decisions made by tax service authorities in respect of our customers, including documentary due diligence conducted in the course of inspection by such authorities. At that, as a company may wish, MinTax can provide following types of services: investigation of issues… Read More

Tax Audit

Presentation of MinTax Group See the Price Policy Download the blank form/questionnaire The tax review is carried out by means of inquiries and analytical procedures in order to identify the significant risks of the company (branch, representative office) associated with the maintenance of tax accounting and fulfillment of tax obligations. The tax review will cover… Read More