Current legislative standards According to paragraph 1 of Article 2 of the RoK Law “On Accounting and Financial Reporting”, the effect of this Law shall extend to: individual entrepreneurs (IE); legal entities, branches, representative offices and permanent establishments of foreign legal entities registered in the Republic of Kazakhstan in accordance with the legislation of the… Read More

On Personal data and their protection

Madina Raspayeva, Senior Lawyer of MinTax LLP, I Category Tax Consultant, in her article considers issues relating to personal data and their protection… Read more

On Personal data and their protection

Seminar on the procedure for CIT assessment for the members of the Accountants Club

As part of the professional development program of the Accountants Club organized by Almaty regional department of “Atameken” National Chamber of Entrepreneurs, on 10th of December 2018 MinTax Group conducted a seminar on the subject “The procedure for the assessment of Corporate Income Tax established by the norms of the new Tax Code. The procedure… Read More

Specific features of subsurface users’ taxation

On 23 November 2018, MinTax Group represented by Andrey Khorunzhiy, Managing Partner, Gaukhar Narbekova, Partner, Director of Audit Department and Mukhtar Bekzhigitov, Partner of Tax Department, conducted a seminar in Almaty on the subject “Taxation of subsurface users. General CIT matters (Form 150.00)”. The seminar was organized by NURIKON LLP training center as part of… Read More

Our congratulations to Yerlan Galiyev

We are happy to congratulate Mr. Yerlan Galiyev, Independent Partner of MinTax Group, PhD, Advocate, on the receipt of the Certificate of Honor from Almaty Municipal College of Advocates to mark his significant contribution to the development of advocacy activity in the Republic of Kazakhstan. We wish him every success in his professional activity, new… Read More

Certification of MinTax Audit LLP environmental management system

MinTax Audit LLP has obtained the Conformity Certificate testifying that the company’s environmental management as applied to Auditing activity under the State License meets the requirements of ST RK ISO 14001-2016 (ISO 14001:2015) “Environmental management systems — Requirements with guidance for use”. The Certificate was registered in the State Register of the State System of… Read More

Important issues related to the court procedure for appealing the results of tax audits

On October 26, 2018 Mr. Yerlan Galiyev, Independent Partner of MinTax Group conducted a seminar at Kazakhstan’s Taxpayer Association on the subject “Important issues related to the court procedure for appealing the results of tax audits”. The seminar was dedicated to topical practical issues of appealing the results of tax audits in the courts of… Read More

Lecture on “Tax monitoring” for Narkhoz University students

On 23 October 2017 MinTax Audit LLP Audit Department assistants Zhuldyz Kaliyeva and Doszhan Yegemkulov came to visit 4th year’s students of Finance and Statistics specialty at Narkhoz University. They gave the students a Kazakh-language lecture on “Tax monitoring”, that covered such subjects as: Monitoring of major taxpayers and how it is performed; Horizontal monitoring as… Read More

Presentation on Audit and State Audit

Zhuldyz Kaliyeva, Consultant of Audit Department of MinTax Audit LLP, who is a candidate for a master’s degree of Al-Farabi Kazakh State University, gives lectures on Audit and State Auidit to the University’s students. We would like to present to your kind attention Zhuldyz’s presentation on the subject: “Basic principles and general approaches to the… Read More

“Taxation of subsurface users” workshop

MinTax Group represented by Andrey Khorunzhiy – Managing Partner and Mukhtar Bekzhigitov – Partner, on 21 September 2018 conducted a free workshop on the subject “Taxation of subsurface users” at the Kazakhstan Taxpayer Association (KTA). The lecturers covered main principles of taxation of subsurface users who are doing business in the RoK, in the light… Read More

“Tax accounting for CIT” Workshop at KTA

On 24 August 2018, MinTax Group represented by Partners: Mukhtar Bekzhigitov and Gaukhar Narbekova, within the framework of long-termcooperation with Kazakhstan Taxpayers’ Association in Expert status, has conducted a workshop dedicated to the subject “Tax accounting for Corporate Income Tax (CIT) or how to calculate CIT”. The lecturers covered the basic principles of the maintenance… Read More

Answers to frequently asked questions about levying taxes in the performance of foreign economic activitiy (FEA)

Aliya Vayissova, Senior Manager of the Tax Department, RoK Professional Accountant, I Category Tax consultant, answered some tax questions

Answers to frequently asked questions about levying taxes in the performance of foreign economic activitiy (FEA)

Tax deduction

In this article, the author, Gaukhar Narbekova, Partner of MinTax Group, RoK Auditor, DipIFR (ACCA), CIPA, CAP expresses

Tax deduction. Error in the example of the Methodological Guidelines may lead to tax disputes

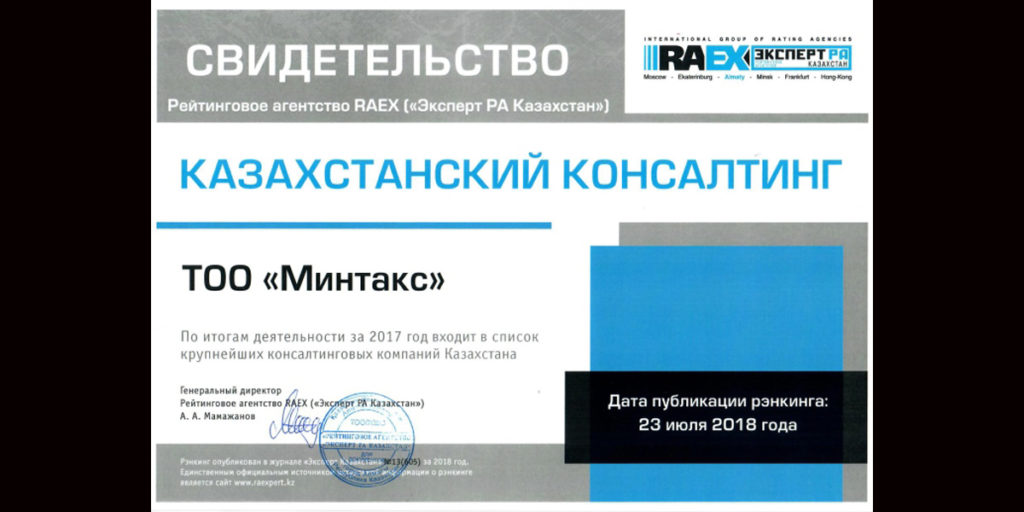

We are in the Top-5 of Kazakhstan’s leading auditing and consulting groups for year 2017

According to the regular ranking of Kazakhstan’s auditing and consulting companies based on 2017 operating

International Taxation Workshop at KTA

On 27 July 2018 in the city of Astana, MinTax Group, within the framework of long-term cooperation with Kazakhstan Taxpayers

Legal restrictions on smoking in public areas

Yerlan Galiev, Independent Partner of MinTax Group answered questions of the popular news portal Tengrinews.kz regarding

OPC payment by individuals working under civil-legal contracts

Individuals who are working under civil-legal contracts are now obliged to pay obligatory pension charges (OPC) to the

Seminar on practical application of changes in the tax legislation

On 27-28 June 2018 at SAT Business Centre MinTax Group conducted a seminar for employees of financial and accounting departments of

Important changes to the Rules for Establishing a Quota for the Use of Foreign Labor in Kazakhstan

Important changes were introduced to the Rules for establishing quota for the use of foreign labor in the Republic of Kazakhstan. In accordance with the Resolution of the Government of the Republic of Kazakhstan No. 189 dated 13 April 2018 “On Amendments and Additions to the Decree No. 802 of the Government of the Republic… Read More

“Financial and Tax Accounting for Property, Plant and Equipment” seminar held at KTA

On 20 April 2018 MinTax Audit LLP, the Expert status member of Kazakhstan Taxpayers’ Association (KTA)in the framework of long-term cooperation, has conducted a regular seminar on the subject “Financial and tax accounting for property, plant and equipment”. The speakers, Gaukhar Narbekova, Partner, Director of Audit Department, RoK Auditor, and Karlygash Abyldayeva, Senior Manager, RoK Auditor,… Read More

Advantages and weaknesses of individuals’ work under civil-legal contracts

Yerlan Galiyev, Independent Partner of MinTax Group, answered some questions of the popular news portal Tengrinews.kz regarding advantages