On September 27, 2019 in the training center of “Auditors’ College” PAO in Almaty, MinTax Group represented by A. Khorunzhiy (Managing Partner), G. Narbekova and M. Bekzhigitov (Partners) has conducted two seminars on the following subjects: “Organization of tax accounting through the accounting policies”. Program of the seminar: Bookkeeping as the basis of tax accounting… Read More

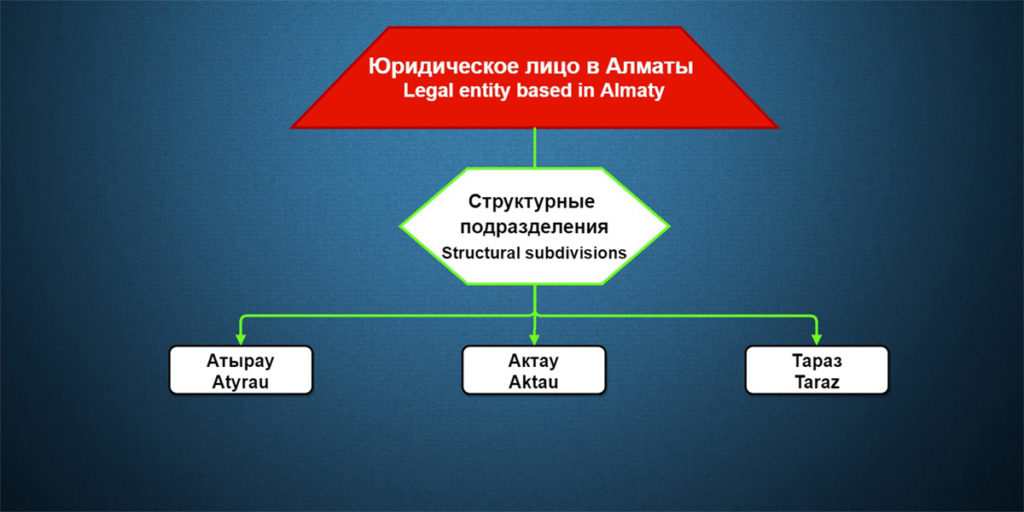

Concerning tax registration of structural units of a legal entity located in various regions of Kazakhstan

This article addresses issues that often come from taxpayers in relation to the right of a resident legal entity of the RoK[1] which has structural divisions in various regions of the RoK. Based on the normal practice of activities of legal entities-residents of the RoK having structural units (branches) in various regions of the RoK… Read More

Concerning tax registration of structural units of a legal entity located in various regions of Kazakhstan

This article addresses issues that often come from taxpayers in relation to the right of a resident legal entity of the RoK[1] which has structural divisions in various regions of the RoK. Based on the normal practice of activities of legal entities-residents of the RoK having structural units (branches) in various regions of the RoK… Read More

Concerning the support of Kazakhstan’s business in the President’s Address

According to the State of the Nation Address of the President Kasym-Jomart Tokayev dated 2 September 2019 “Constructive Public Dialogue – The Basis of Stability and Prosperity of Kazakhstan”, the state and society are expected to face important socio-economic changes. In particular, the President’s Address proclaims important changes in the sphere of support of micro- and… Read More

Tax obligations related to granting loans to non-residents – related parties

Gaukhar Narbekova, Partner of MinTax Group, Certified Auditor, DipIFR (ACCA), CIPA, CAP, Professional Tax Advisor, Tax Consultant of the RoK[1] in this article considers possible variants of granting a loan by a legal entity – resident of the RoK (hereinafter – RoK Resident) to its Participant or its related party which are non-residents of the… Read More

Tax obligations related to granting loans to non-residents – related parties

Gaukhar Narbekova, Partner of MinTax Group, Certified Auditor, DipIFR (ACCA), CIPA, CAP, Professional Tax Advisor, Tax Consultant of the RoK[1] in this article considers possible variants of granting a loan by a legal entity – resident of the RoK (hereinafter – RoK Resident) to its Participant or its related party which are non-residents of the… Read More

We are in the TOP-10 of the leading auditing and consulting groups of Kazakhstan in 2018

According to results of the regular ranking of Kazakhstan’s auditing and consulting companies based on 2018 performance results, prepared by Expert RA Kazakhstan Rating Agency, MinTax Audit LLP and MinTax LLP are still holding the leading positions in the list of auditing and consulting groups of Kazakhstan. In particular, according to 2018 performance results, MinTax… Read More

Congratulations to our colleagues – Raushan Madiyeva and Oksana Lyan

We are happy to congratulate our colleagues from MinTax Audit LLP – Raushan Madiyeva, Senior Manager of the Audit Department and Oksana Lyan – Senior Consultant of the Outsourcing Department on obtaining DipIFR qualification after successful passing examinations. We wish them new professional achievements, health, happiness. With warm regards, Colleagues

External quality control passed successfully

The “College of Auditors” accredited professional audit organization has conducted an external quality control at MinTax Audit LLP to check whether, in auditing financial statements, it complies with: – applicable legislation of the Republic of Kazakhstan; – International Standards on Auditing (ISA) and the IFAC International Standard for Quality Control No. 1; – Code of… Read More

Participation in the first meeting of Tax Club pilot project

The “Chamber of Tax Consultants” Public Association (republican status) together with the NARXOZ University launched a pilot project “Tax Club”, the first meeting of which was held on June 5, 2019 at 15-00 at the address: Almaty, ULK, 81 Sain Street, room 220. The speakers of this meeting on the subject: “Tax security of the… Read More

Important changes in state purchases in 2019

Saltanat Seilbekova, Consultant of MinTax LLP, in her article considers important changes in the sphere of purchases that took place in 2019. In the beginning of year 2019, some amendments and additions were introduced to RoK[1]legislation regulating the sphere of state purchases, purchases of Samruk Kazyna National Welfare Fund JSC[2] and purchases of subsurface users.… Read More

Important changes in state purchases in 2019

Saltanat Seilbekova, Consultant of MinTax LLP, in her article considers important changes in the sphere of purchases that took place in 2019. In the beginning of year 2019, some amendments and additions were introduced to RoK[1]legislation regulating the sphere of state purchases, purchases of Samruk Kazyna National Welfare Fund JSC[2] and purchases of subsurface users.… Read More

We are holders of the “Industry Leader” title

MinTax Group companies are in the TOP list in their area of activity according to results of the independent ranking analysis held in 2019 by the Union of National Business Ratings (NBR Union) among the entities doing business in the sphere of audit, tax consulting, accounting. The analysis was based on information about the payment… Read More

Lecture on international taxation at Narkhoz University

On March 18, 2019 Zhuldyz Kalieva, Consultant of the Audit Department of MinTax Audit LLP conducted a lecture in the Kazakh language at Narkhoz University on the subject “International Taxation” for 4th year’s students of the “Finance and Statistics” specialty. In the course of her lecture, Zhuldyz covered such issues as: Main changes in international… Read More

Seminar on the procedure for preparing Form 100.00 CIT Declaration

Within the framework of cooperation with Kazakhstan Taxpayers Association (Expert status), on 15 March 2019 MinTax Group conducted a regular seminar in Almaty on the subject “Procedure for preparing Form 100.00 “Corporate income tax declaration” for 2018. Lecturers: Andrey Khorunzhiy, Managing Partner of MinTax Group, Partners, Heads of Audit ad Tax Departments – Gaukhar Narbekova… Read More

New measures for the government support of young specialists

“No weapon is sharper than labour-based knowledge” (М. Gorky) Asiya Burkutova, Senior Lawyer of MinTax LLP, I Category Tax Consultant, in her article covers issues relating to measures of material support of young specialists provided by the Government. Read more

New measures for the government support of young specialists

For material support of young specialists, the Government has introduced a number of measures. Based on the youth labour market indicators for the Republic of Kazakhstan in 2001–2018[1], we can see that the youth unemployment rate in the Republic of Kazakhstan is declining. In particular, according to results of the 4th quarter of 2018, the… Read More

“Practical issues of filling out the Form 150.00” Seminar

On 31 January – 1 February 2019 in Almaty, MinTax Group conducted a two-days’ seminar on the subject “Practical issues of filling out the Form 150.00”, organized by NURIKON LLP training centre for employees of accounting and tax departments of subsurface companies. During the seminar our lecturers covered the following issues relating to the specific… Read More

Which taxpayers are exempt from the maintenance of accounting records in the RoK?

Author: Andrey Khorunzhiy, Managing Partner of MinTax Group. Current legislative standards According to paragraph 1 of Article 2 of the RoK Law “On Accounting and Financial Reporting”, the effect of this Law shall extend to: individual entrepreneurs (IE); legal entities, branches, representative offices and permanent establishments of foreign legal entities registered in the Republic of… Read More

Which taxpayers are exempt from the maintenance of accounting records in the RoK?

Current legislative standards According to paragraph 1 of Article 2 of the RoK Law “On Accounting and Financial Reporting”, the effect of this Law shall extend to: individual entrepreneurs (IE); legal entities, branches, representative offices and permanent establishments of foreign legal entities registered in the Republic of Kazakhstan in accordance with the legislation of the… Read More

On Personal data and their protection

Madina Raspayeva, Senior Lawyer of MinTax LLP, I Category Tax Consultant, in her article considers issues relating to personal data and their protection… Read more

On Personal data and their protection

Seminar on the procedure for CIT assessment for the members of the Accountants Club

As part of the professional development program of the Accountants Club organized by Almaty regional department of “Atameken” National Chamber of Entrepreneurs, on 10th of December 2018 MinTax Group conducted a seminar on the subject “The procedure for the assessment of Corporate Income Tax established by the norms of the new Tax Code. The procedure… Read More

Specific features of subsurface users’ taxation

On 23 November 2018, MinTax Group represented by Andrey Khorunzhiy, Managing Partner, Gaukhar Narbekova, Partner, Director of Audit Department and Mukhtar Bekzhigitov, Partner of Tax Department, conducted a seminar in Almaty on the subject “Taxation of subsurface users. General CIT matters (Form 150.00)”. The seminar was organized by NURIKON LLP training center as part of… Read More