Yerlan Galiyev, attorney at law, partner of MinTax Group, ӘдiлетЖарғысы lawyer’s office. The complexity, variability of tax laws and the existence of legal gaps is the causes of numerous tax disputes between the state and taxpayers.

About the correctness of applying the “0” correction factor during the period of crisis situations

Laura Satybaldina, Senior Manager of MinTax LLP, in her article considers the issue of the correctness of application by taxpayers of the “0” correction factor which was introduced as a measure to ensure socio-economic stability for the period of the crisis situation in 2020 due to the COVID-19 pandemic. As you may remember, in March… Read More

Procedure for the presentation of transactions under long-term contracts in the accounting and tax records

In this article, Gaukhar Narbekova, Partner of MinTax Group, Director of the Audit Department, describes the procedure for the presentation of transactions under long-term contracts in the accounting and tax records using an example taken from practical experience in the course of rendering audit and consulting services to organizations providing services to subsoil users. In… Read More

On applying a standard tax deduction to income of foreign employees

Aliya Vaisova, Senior Manager of MinTax LLP, in her article tells about applying a deduction in the amount of one minimum wage (hereinafter – MW) to the income of employees who are citizens of foreign countries, when assessing the liabilities for PIT[1] withheld at the source of payment in the RoK[2]. In connection with frequently… Read More

The use of used spare parts – yes or no?

Ulan Batenov, Manager of Mintax LLP Legal Department, in his article tells about some changes in the Technical Regulations of the Customs Union “On the safety of wheeled vehicles” (TR CU 018/2011). I believe that, first of all, the readers’ eyes were struck by a topic for an article unusual for this site, and in… Read More

Important changes in the labour legislation of the RoK

Ulan Batenov, Manager of Legal Department of MinTax LLP, in his article considers some changes introduced to the labor legislation of the Republic of Kazakhstan (RoK) by the RoK Law #321-VІ ZRK dated 4 May 2020. The reason for writing this article, as mentioned in the introduction, were the numerous changes made to the RoK… Read More

Important aspects of goods conformity certification

Ulan Batenov, Manager of Legal Department of Mintax LLP, in his article informs about certain amendments in the regulatory legal acts of the Republic of Kazakhstan on conformity certification issues. This article addresses the changes made to the Rules for suspension or cancellation of the issued certificates of conformity or the registration of conformity declarations… Read More

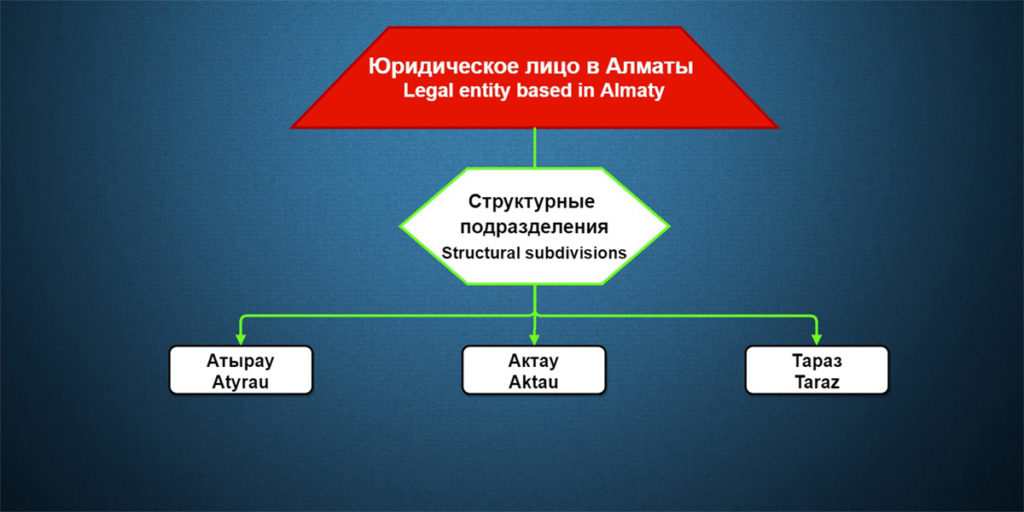

Concerning tax registration of structural units of a legal entity located in various regions of Kazakhstan

This article addresses issues that often come from taxpayers in relation to the right of a resident legal entity of the RoK[1] which has structural divisions in various regions of the RoK. Based on the normal practice of activities of legal entities-residents of the RoK having structural units (branches) in various regions of the RoK… Read More

Tax obligations related to granting loans to non-residents – related parties

Gaukhar Narbekova, Partner of MinTax Group, Certified Auditor, DipIFR (ACCA), CIPA, CAP, Professional Tax Advisor, Tax Consultant of the RoK[1] in this article considers possible variants of granting a loan by a legal entity – resident of the RoK (hereinafter – RoK Resident) to its Participant or its related party which are non-residents of the… Read More

Important changes in state purchases in 2019

Saltanat Seilbekova, Consultant of MinTax LLP, in her article considers important changes in the sphere of purchases that took place in 2019. In the beginning of year 2019, some amendments and additions were introduced to RoK[1]legislation regulating the sphere of state purchases, purchases of Samruk Kazyna National Welfare Fund JSC[2] and purchases of subsurface users.… Read More

Lecture on international taxation at Narkhoz University

On March 18, 2019 Zhuldyz Kalieva, Consultant of the Audit Department of MinTax Audit LLP conducted a lecture in the Kazakh language at Narkhoz University on the subject “International Taxation” for 4th year’s students of the “Finance and Statistics” specialty. In the course of her lecture, Zhuldyz covered such issues as: Main changes in international… Read More

Which taxpayers are exempt from the maintenance of accounting records in the RoK?

Current legislative standards According to paragraph 1 of Article 2 of the RoK Law “On Accounting and Financial Reporting”, the effect of this Law shall extend to: individual entrepreneurs (IE); legal entities, branches, representative offices and permanent establishments of foreign legal entities registered in the Republic of Kazakhstan in accordance with the legislation of the… Read More

Presentation on Audit and State Audit

Zhuldyz Kaliyeva, Consultant of Audit Department of MinTax Audit LLP, who is a candidate for a master’s degree of Al-Farabi Kazakh State University, gives lectures on Audit and State Auidit to the University’s students. We would like to present to your kind attention Zhuldyz’s presentation on the subject: “Basic principles and general approaches to the… Read More